Class 12th Account chapter 1 question 21 solution (ts grewal)

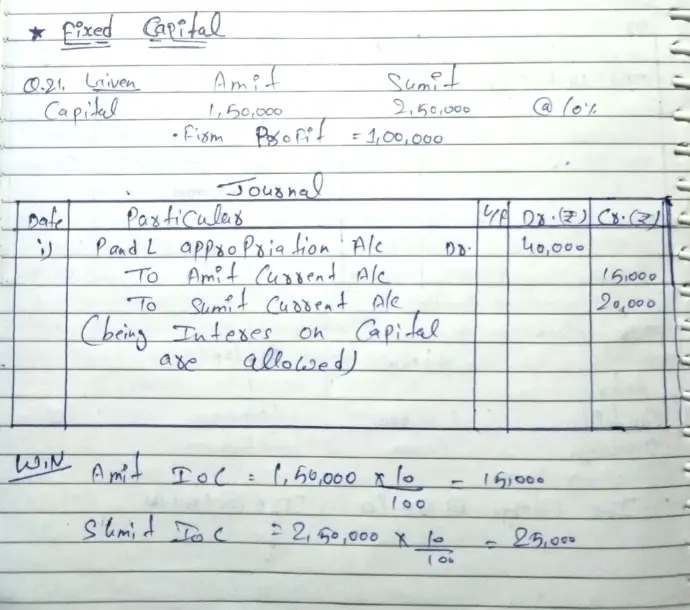

Question 21. Amit and Sumit entered into partnership on 1st April, 2023 and invested ₹ 1,50,000 and ₹ 2,50,000 respectively as capitals. The Partnership Deed provided for interest on capitals @ 10% p.a. It also provided that Capital Accounts shall be maintained following Fixed Capital Accounts Method. The firm earned net profit of ₹ 1,00,000 for the year ended 31st March, 2024.

Pass the Journal entry for interest on capital.

[Ans.: Dr. Profit & Loss Appropriation A/c by ₹ 40,000; Cr. Amit’s Current A/c by ₹ 15,000 and Sumit’s Current A/c by ₹ 25,000]

SOLUTION :-